Banking sector has always be in forefront of technology innovation and this is being used extensively by Bank , We have analysed and following are key area where there is definite traction and banks are investing heavily.

AML Pattern Detection

Anti-money laundering (AML) refers to a set of procedures, laws or regulations designed to stop the practice of generating income through illegal actions. In most cases, money launderers hide their actions through a series of steps that make it look like money that came from illegal or unethical sources are earned legitimately

Most of the major banks across the globe are shifting from rule based software systems to artificial intelligence based systems which are more robust and intelligent to the anti-money laundering patterns. Over the coming years, these systems are only set to become more and more accurate and fast with the continuous innovations and improvements in the field of artificial intelligence.

Chat Bots

Chat bots are artificial intelligence based automated chat systems which simulate human chats without any human interventions. They work by identifying the context and emotions in the text chat by the human end user and respond to them with the most appropriate reply. With time, these chat bots collect massive amount of data for the behaviour and habits of the user and learns the behaviour of user which helps to adapts to the needs and moods of the end user.

Chat bots are already being extensively used in the banking industry to revolutionize the customer relationship management at personal level. Bank of America plans to provide customers with a virtual assistant named “Erica” who will use artificial intelligence to make suggestions over mobile phones for improving their financial affairs. Allo, released by Google is another generic realization of chat bots.

Algorithmic trading

Plenty of Hedge funds across the globe are using high end systems to deploy artificial intelligence models which learn by taking input from several sources of variation in financial markets and sentiments about the entity to make investment decisions on the fly. Reports claim that more than 70% of the trading today is actually carried out by automated artificial intelligence systems. Most of these hedge funds follow different strategies for making high frequency trades (HFTs) as soon as they identify a trading opportunity based on the inputs.

A few hedge funds active in AI space are: Two Sigma, PDT Partners, DE Shaw, Winton Capital Management, Ketchum Trading, LLC, Citadel, Voleon, Vatic Labs, Cubist, Point72, Man AHL

Fraud detection

Fraud detection is one of the fields which has received massive boost in providing accurate and superior results with the intervention of artificial intelligence. It’s one of the key areas in banking sector where artificial intelligence systems have excelled the most. Starting from the early example of successful implementation of data analysis techniques in the banking industry is the FICO Falcon fraud assessment system, which is based on a neural network shell to deployment of sophisticated deep learning based artificial intelligence systems today, fraud detection has come a long way and is expected to further grow in coming years.

Customer recommendations

Recommendation engines are a key contribution of artificial intelligence in banking sector. It is based on using the data from the past about users and/ or various offerings from a bank like credit card plans, investment strategies, funds, etc. to make the most appropriate recommendation to the user based on their preferences and the users’ history. Recommendation engines have been very successful and a key component in revenue growth accomplished by major banks in recent times.

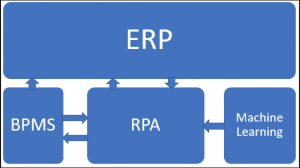

We help our customer to identify right solution for our client.